How to Calculate Your Monthly Home Costs

Understanding how much you will pay each month for a home is crucial for budgeting and financial planning. Whether you're considering buying a new house or just curious about the costs associated with a property you pass by, knowing how to estimate your monthly payment can save you from financial surprises down the road. This blog will guide you through the steps to calculate your monthly home costs, including mortgage, taxes, and other fees.

The Basics of Home Cost Calculation

When you think about buying a home, the first thing that comes to mind is often the purchase price. However, the total monthly cost involves much more than just the mortgage payment. To get an accurate estimate, you need to consider several factors:

- Mortgage Payment: The principal and interest on your home loan.

- Property Taxes: Local government taxes based on your home's assessed value.

- Homeowners Insurance: Insurance that protects your home and belongings from damage or theft.

- Private Mortgage Insurance (PMI): Required if your down payment is less than 20%.

- Homeowners Association (HOA) Fees: Fees for maintaining common areas in a community.

Using a Mortgage Calculator

One of the easiest ways to calculate your monthly home costs is by using a mortgage calculator. This tool allows you to input various factors to see how they affect your monthly payment. Here's how to use it effectively:

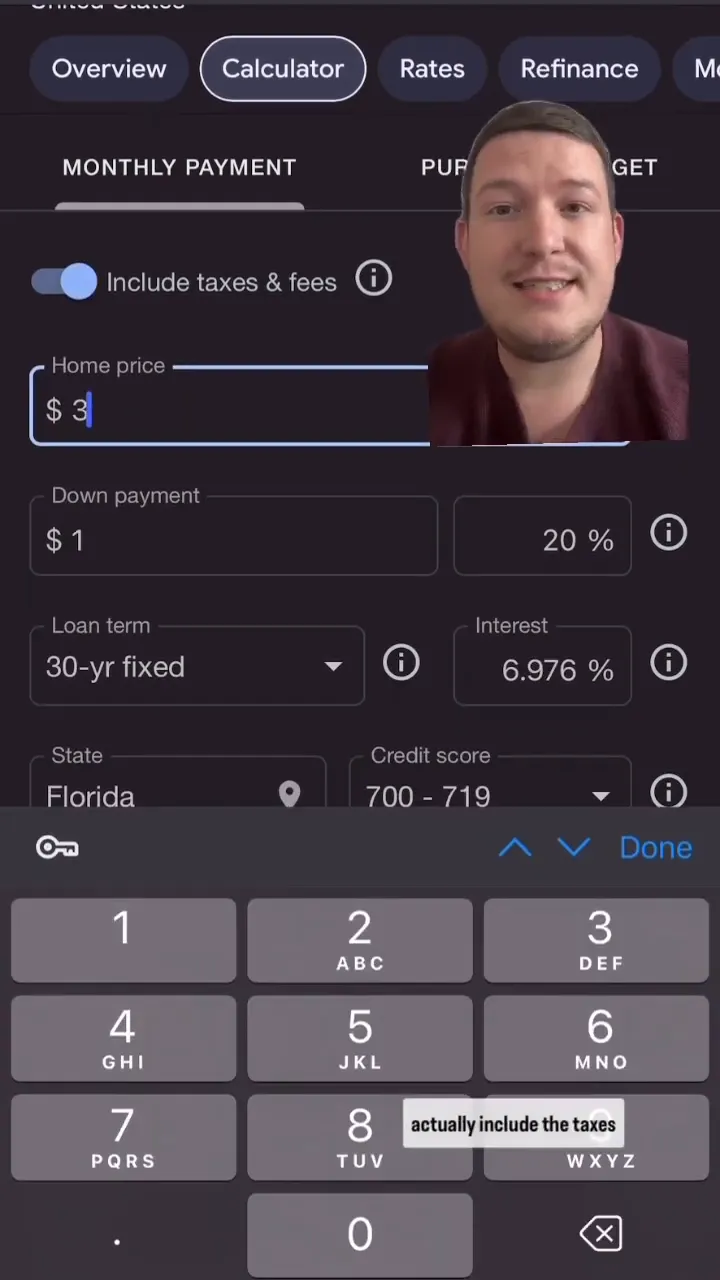

Step 1: Input the Home Price

Start by entering the purchase price of the home. For example, if you see a house listed for $375,000, you would input that amount into the calculator.

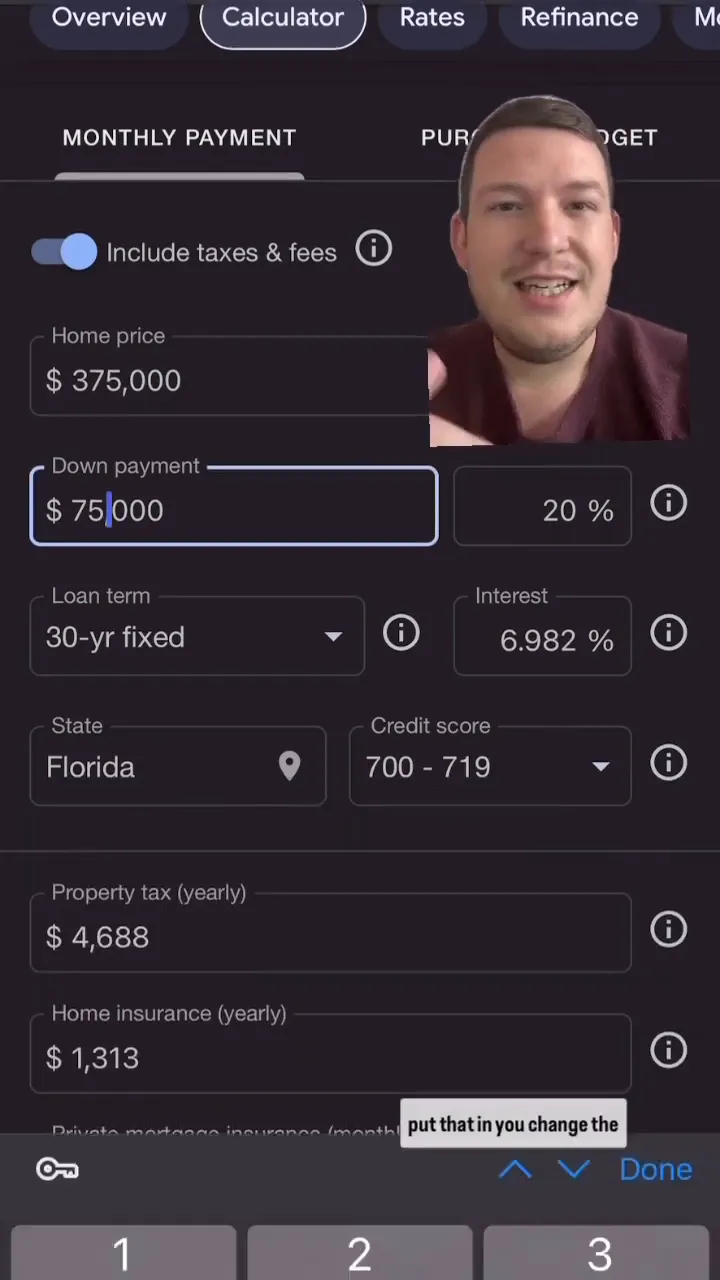

Step 2: Adjust the Down Payment

The down payment is the amount you pay upfront for the house. If you don't have the typical 20% down payment (which would be $75,000 for a $375,000 home), you can adjust this number. For instance, you might have $25,000 to put down. Enter this amount into the calculator.

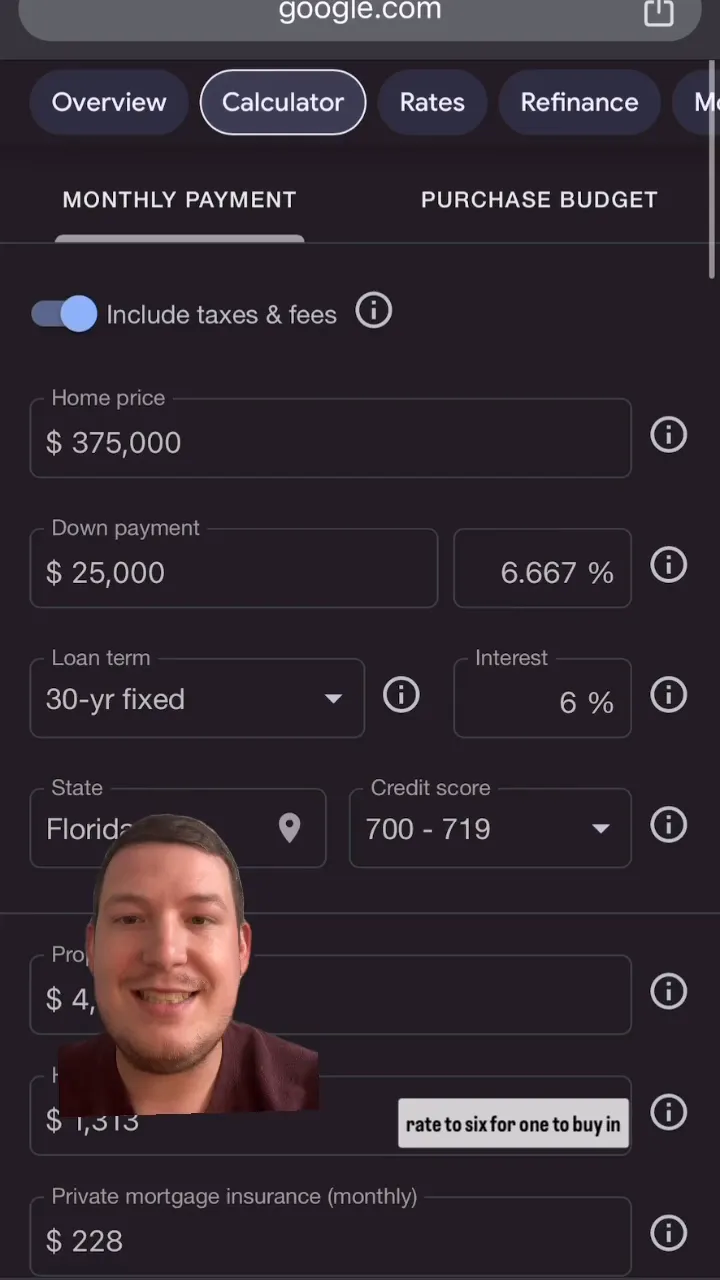

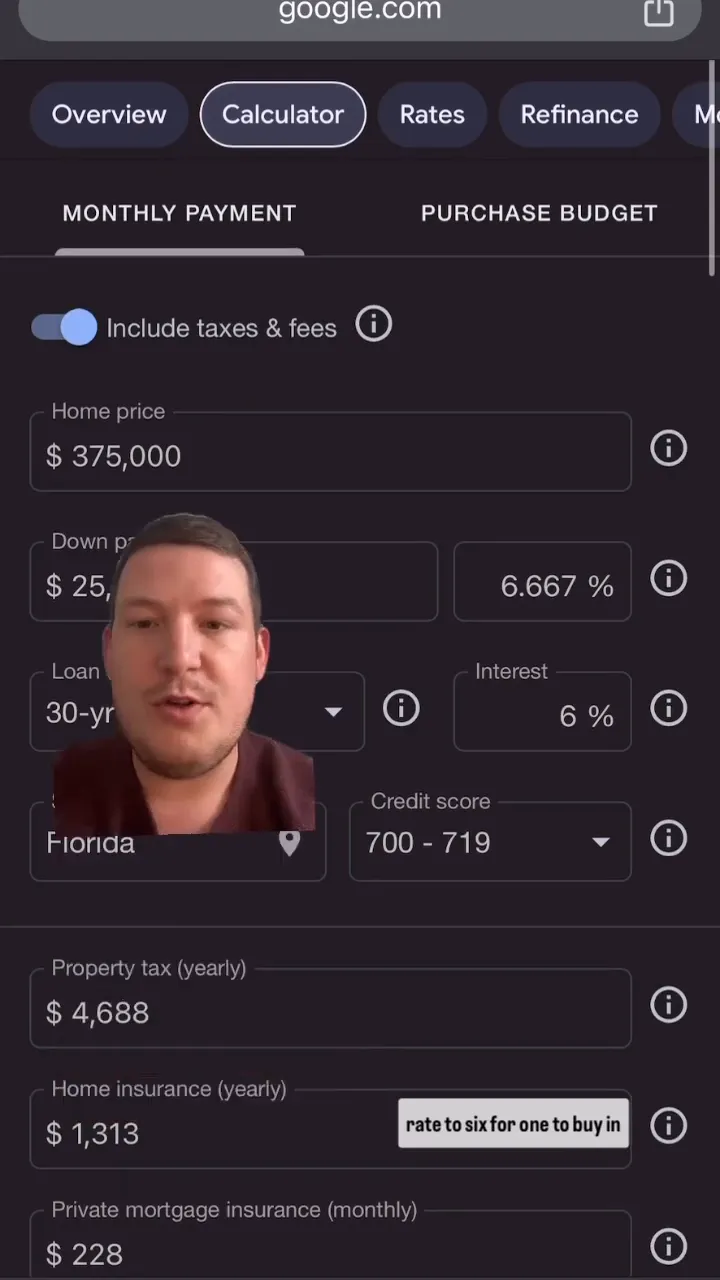

Step 3: Set the Interest Rate

The interest rate is a crucial factor in determining your mortgage payment. You can adjust this based on current rates. For example, if you want to use a 6% interest rate, enter that into the calculator.

Step 4: Include Additional Costs

In addition to the mortgage payment, you should include other monthly costs like:

- Property Taxes

- Homeowners Insurance

- PMI (if applicable)

- HOA Fees (if applicable)

These costs can vary significantly based on location and property type, so it's essential to research and input accurate figures.

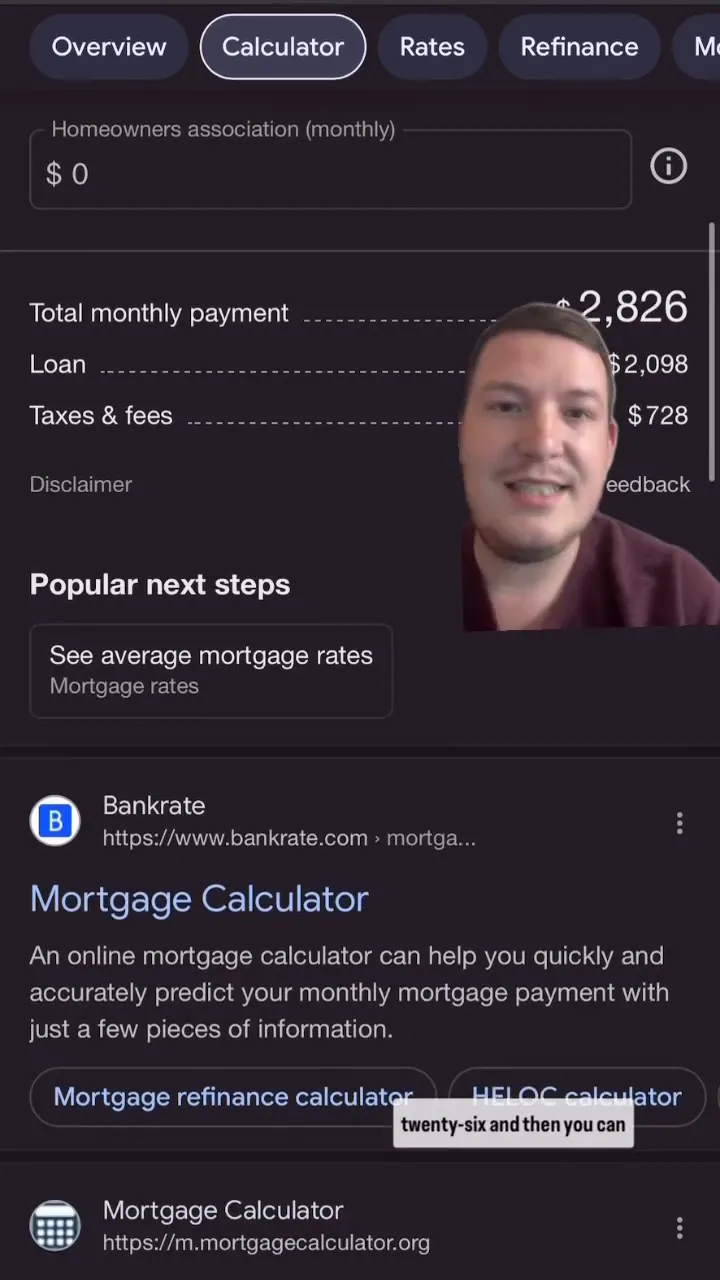

Step 5: Calculate Your Total Monthly Payment

Once you've input all the necessary information, the calculator will provide you with your total monthly payment. For instance, after entering the above values, you might find that your monthly payment is approximately $2,826.

Playing Around with Numbers

One of the advantages of using a mortgage calculator is that you can easily adjust different variables to see how they affect your monthly payment. Want to see how a different purchase price or interest rate changes your costs? Simply adjust the numbers and recalculate. This feature allows you to find a comfortable price range for your future home.

Understanding the Components of Your Payment

To better understand your monthly payment, let's break down its components:

1. Mortgage Payment

Your mortgage payment is usually the largest part of your monthly cost. It consists of two main components: the principal, which is the amount borrowed, and the interest, which is the cost of borrowing that money. The longer your loan term, the lower your monthly payment, but you may pay more in interest over time.

2. Property Taxes

Property taxes can vary widely depending on your location. They are typically calculated as a percentage of your home's assessed value. Make sure to check your local rates to get an accurate estimate.

3. Homeowners Insurance

This insurance protects your home and belongings. The cost can depend on various factors, including the value of your home and the coverage amount. It's essential to shop around for the best rates.

4. PMI

If your down payment is less than 20%, most lenders will require you to pay PMI. This insurance protects the lender in case you default on the loan. PMI can add a significant amount to your monthly payment, so it's essential to factor it in if applicable.

5. HOA Fees

If you buy a home in a community with an HOA, be prepared to pay monthly or annual fees. These fees cover the maintenance of common areas and amenities. They can vary widely, so check with the HOA for specific costs.

Conclusion

Calculating your monthly home costs is a vital part of the home-buying process. By using a mortgage calculator, you can easily estimate your payments and understand the various factors that contribute to your total monthly cost. Whether you're actively searching for a home or just curious, this knowledge empowers you to make informed financial decisions.

Ready to start calculating? Find a mortgage calculator online and begin playing with the numbers to see what you can afford. Happy house hunting!

.jpg?alt=media&token=47c7857d-2e71-439f-a2d7-246977432edc/)

Schedule a Time To Discuss Next Steps

If you are looking to make a real estate move set up a time below for a quick phone call!

Lets Go!

Comments

Post a Comment