St. Johns County Housing Market Update: August 2024

Overview of the St. Johns County Market

The housing market in St. Johns County is currently experiencing fluctuations, particularly in the single-family home sector. As we delve into the August 2024 market stats, we will analyze the median sales price, closed sales, days on market, and the impact of interest rates on buyers. Understanding these aspects will provide a clearer picture of what is happening in the local real estate landscape.

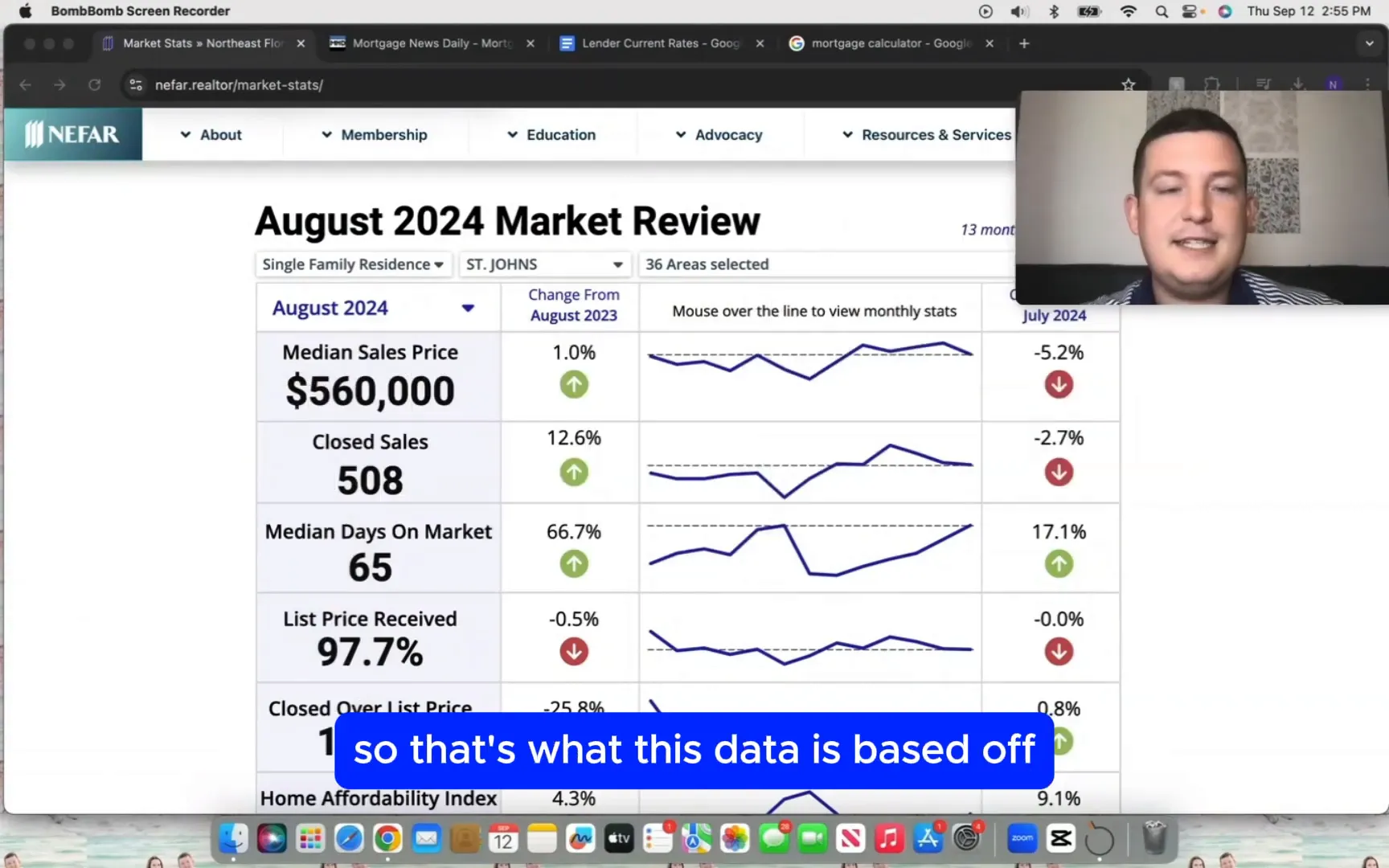

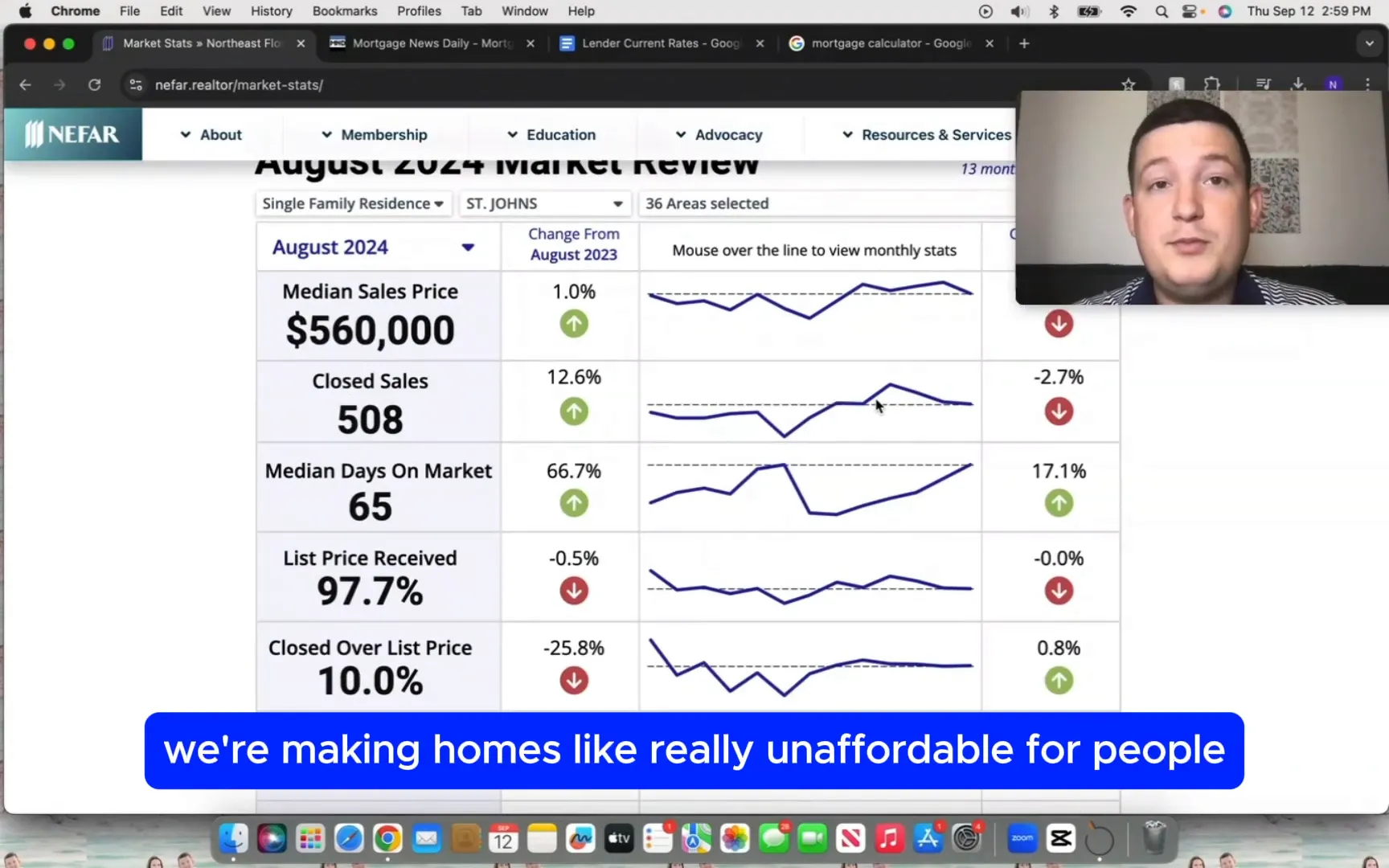

In August, the median sales price for homes decreased approximately 5% to $560,000. This drop can be attributed to the prevalence of newer construction homes in the area, which often require price adjustments to attract buyers. Despite this decline, the number of closed sales only saw a slight decrease of 2.7% from the previous month, totaling 508 sales. However, this figure represents an increase of over 12.5% compared to August 2023, indicating a year-over-year growth trend.

Days on Market and Sales Trends

Another significant metric is the average days on market, which has steadily increased since February. In August, homes spent an average of 65 days on the market, reflecting a 17.1% rise from the previous month. This trend suggests that buyers are taking more time to make decisions, likely due to economic factors and interest rates.

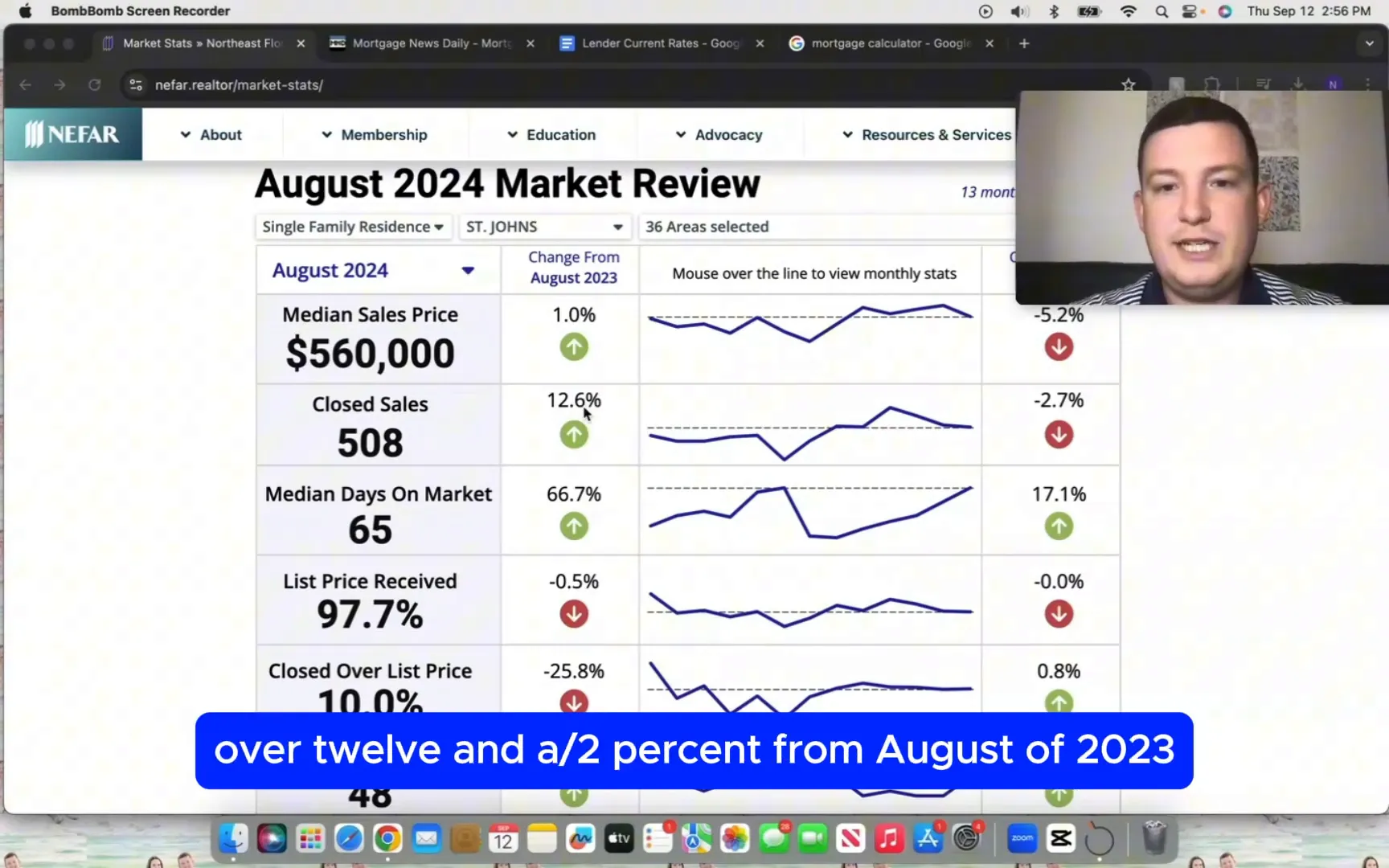

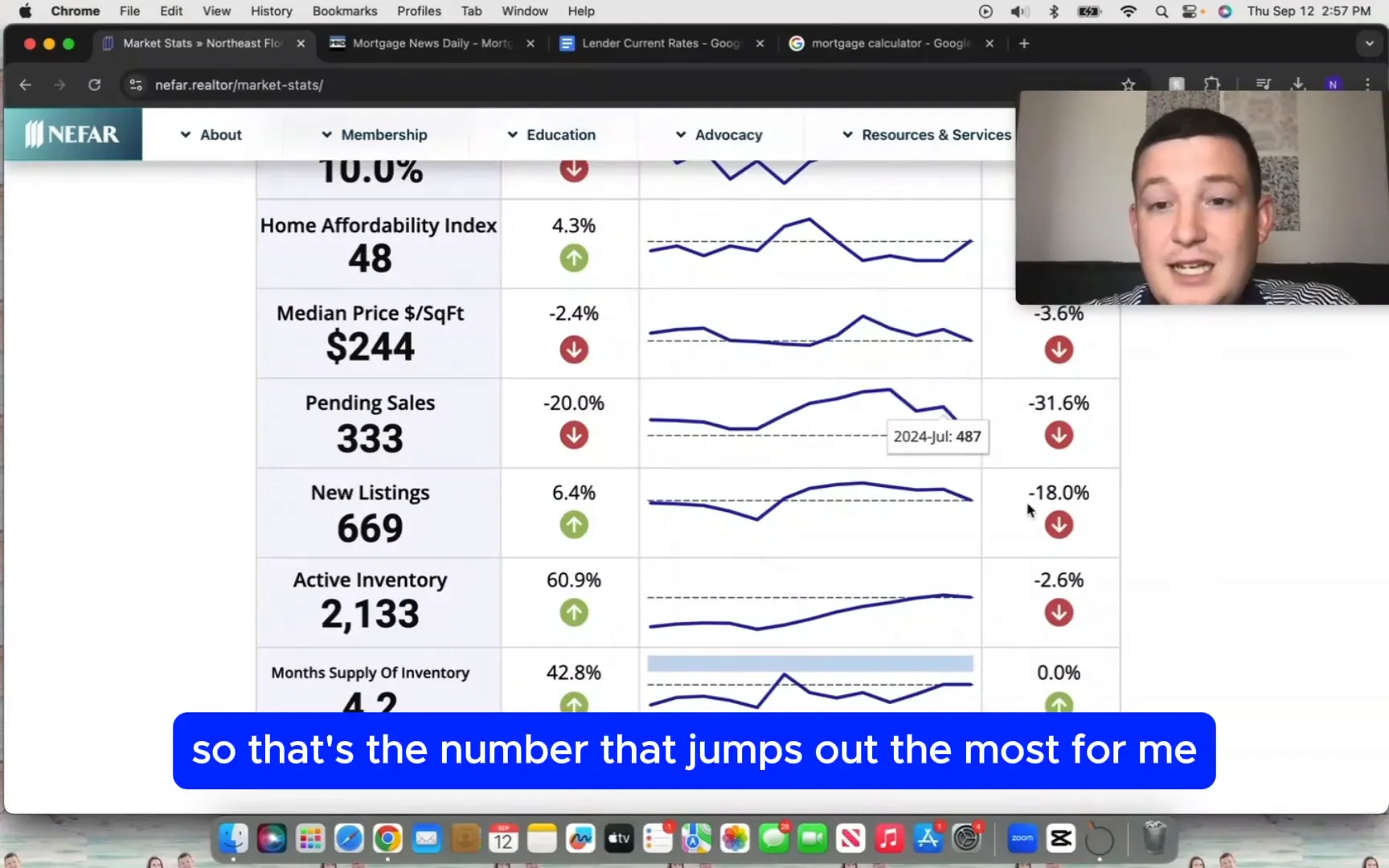

One notable statistic is the dramatic drop in the number of homes that went under contract in August, which fell by 31.6%. From 487 homes in July, the number plummeted to just 333 in August. This significant decline indicates a slowdown in buyer activity, which will likely affect future closed sales numbers.

Inventory Levels

Despite the drop in contracts, the active inventory has also slightly decreased, resulting in approximately 4.2 months of available homes on the market. This metric is essential as it helps gauge the balance between supply and demand. A lower inventory level can often lead to increased competition among buyers, which may stabilize or even increase prices in the future.

As we move forward, it’s crucial to monitor how these inventory levels change in conjunction with buyer demand and interest rates. A well-balanced market typically has around six months of inventory, so the current supply suggests a seller's market, albeit a weakening one.

Interest Rates and Their Impact

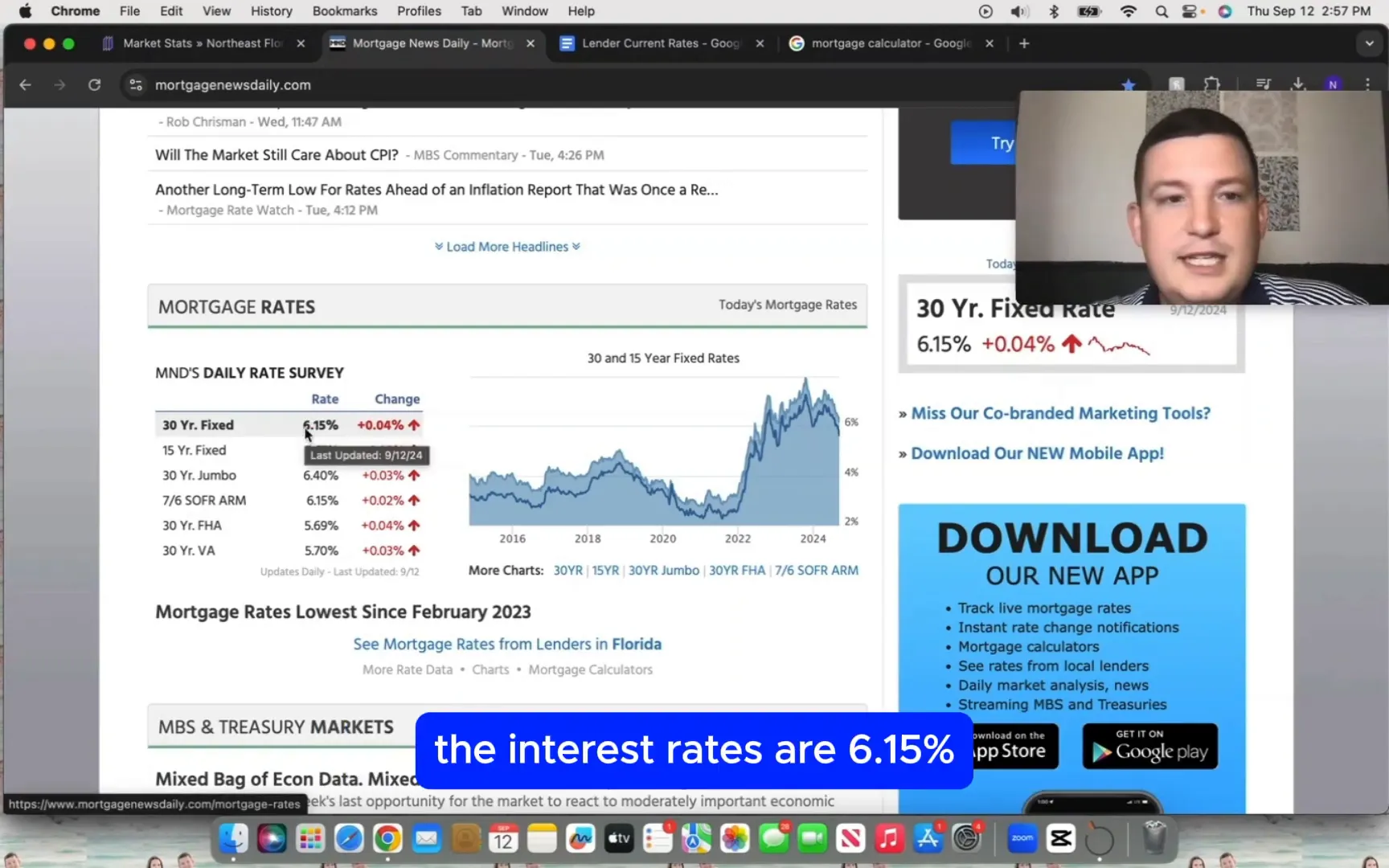

Interest rates play a pivotal role in the housing market, influencing buyers' purchasing power. As of August 2024, the average interest rate for a conventional fixed thirty-year mortgage stands at 6.15%. This marks a slight increase from 6.11% in previous months, which was the lowest seen in the last eighteen months.

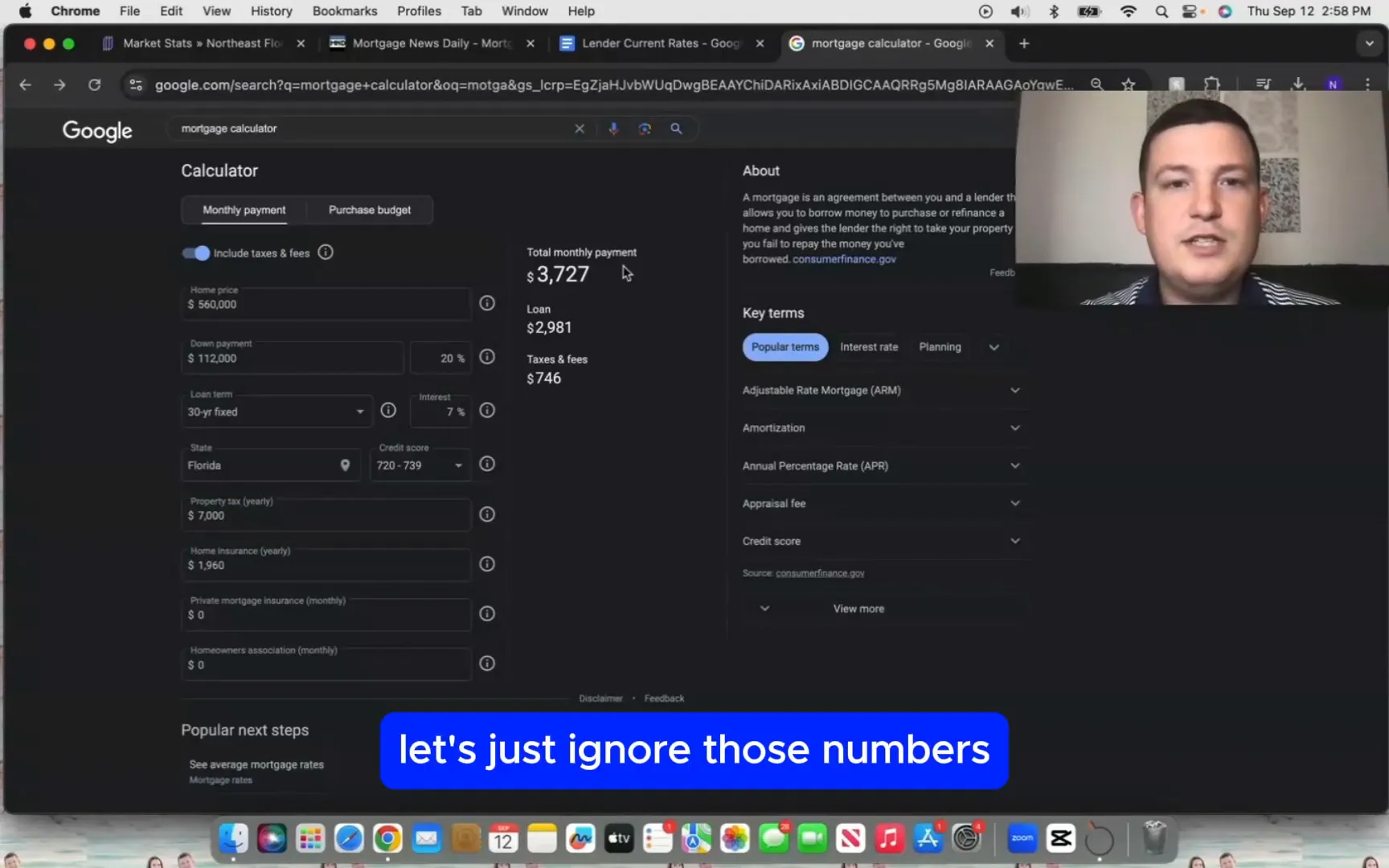

For FHA and VA loans, the rates are slightly lower, at 5.69% and 5.75%, respectively. These rates are crucial for buyers, as even a small change can significantly impact their monthly payments. For instance, a buyer purchasing a median-priced home at $560,000 with a 20% down payment would experience substantial savings if interest rates decrease.

For example, a 7% interest rate would result in a monthly payment of approximately $3,727. However, with the current rate of 6.15%, that payment drops to $3,475, providing a monthly savings of around $250. If the rate were to fall to 5.75%, the payment would decrease further to $3,360, saving the buyer nearly $365 monthly, which totals about $4,000 annually.

The Future of St. Johns County Real Estate

As we analyze these trends, it’s clear that the St. Johns County housing market is in a state of transition. The combination of rising interest rates, fluctuating inventory, and changing buyer behavior indicates that both buyers and sellers need to be strategic in their approaches. Sellers may need to adjust their expectations regarding pricing and be prepared for longer days on the market.

Buyers, on the other hand, should remain informed about interest rates and be ready to act when favorable conditions arise. As interest rates stabilize or potentially decrease, we may see a resurgence in buyer activity, leading to a more competitive market. Understanding these dynamics will be essential for anyone looking to buy or sell in the upcoming months.

Conclusion

The August 2024 housing market update for St. Johns County reveals a complex interplay of factors influencing real estate activity. With a decrease in median sales prices, an increase in days on the market, and a significant drop in homes going under contract, both buyers and sellers need to navigate this evolving landscape with care.

If you have any questions about the current market conditions or need assistance with buying or selling a home, feel free to reach out. With the right guidance and information, you can make informed decisions that align with your real estate goals.

For more detailed insights, check out the NEFAR St Johns County Market Stats.

To schedule a consultation, you can book a 15-minute call with me.

Stay connected and follow my journey on Instagram.

.jpg?alt=media&token=47c7857d-2e71-439f-a2d7-246977432edc/)

Schedule a Time To Discuss Next Steps

If you are looking to make a real estate move set up a time below for a quick phone call!

Lets Go!

Comments

Post a Comment