Understanding the Jacksonville Real Estate Market: August 2024 Insights

The Jacksonville real estate market is always evolving, and August 2024 shows some notable trends and statistics. In this blog, we will delve into the current state of the market, including changes in median sales price, inventory levels, and interest rates. These insights will help potential buyers and sellers navigate their decisions in this dynamic environment.

Current Market Overview

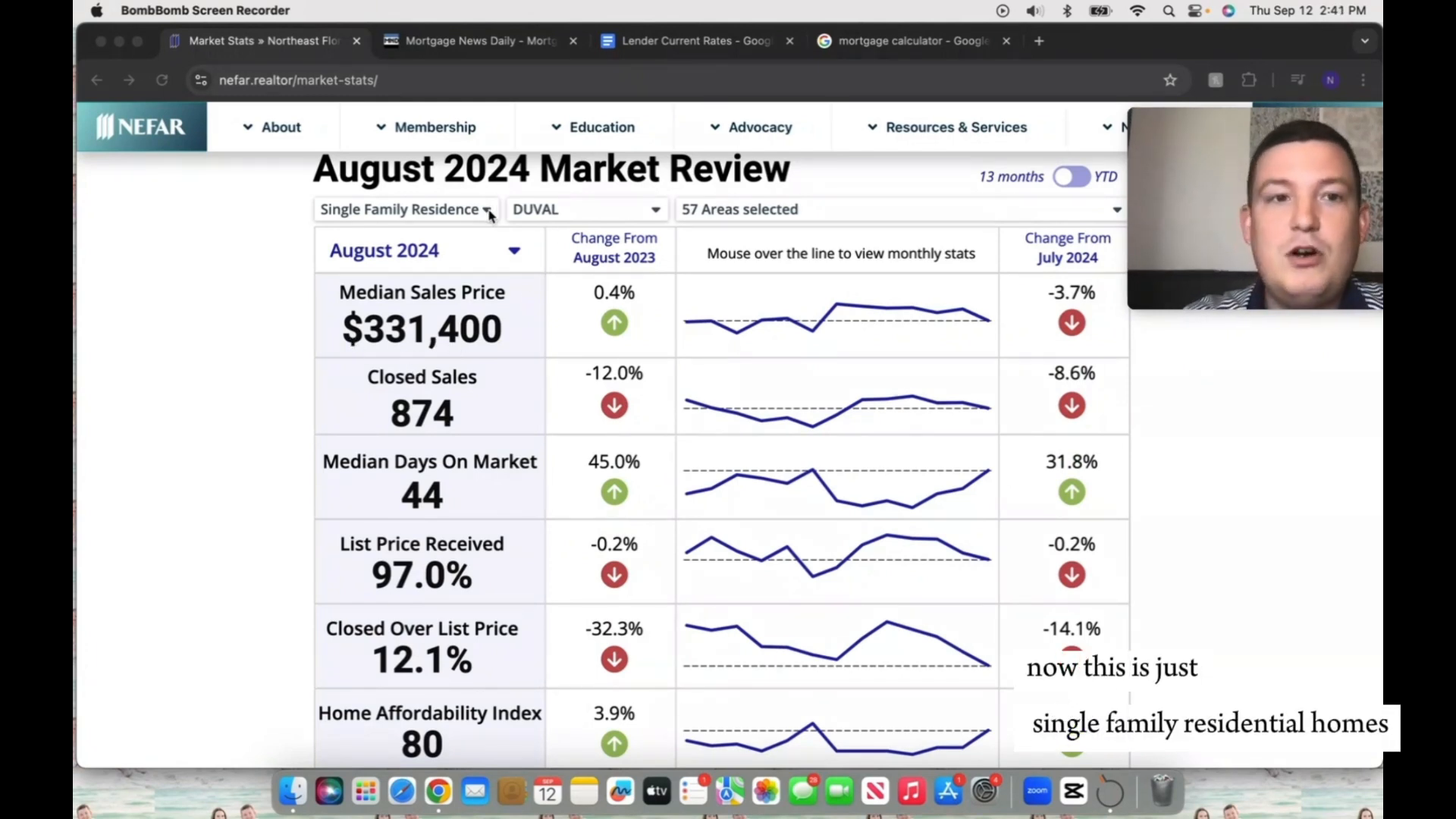

As of August 2024, the median sales price for single-family homes in Duval County has seen a slight decrease. This trend reflects broader market conditions and buyer behavior.

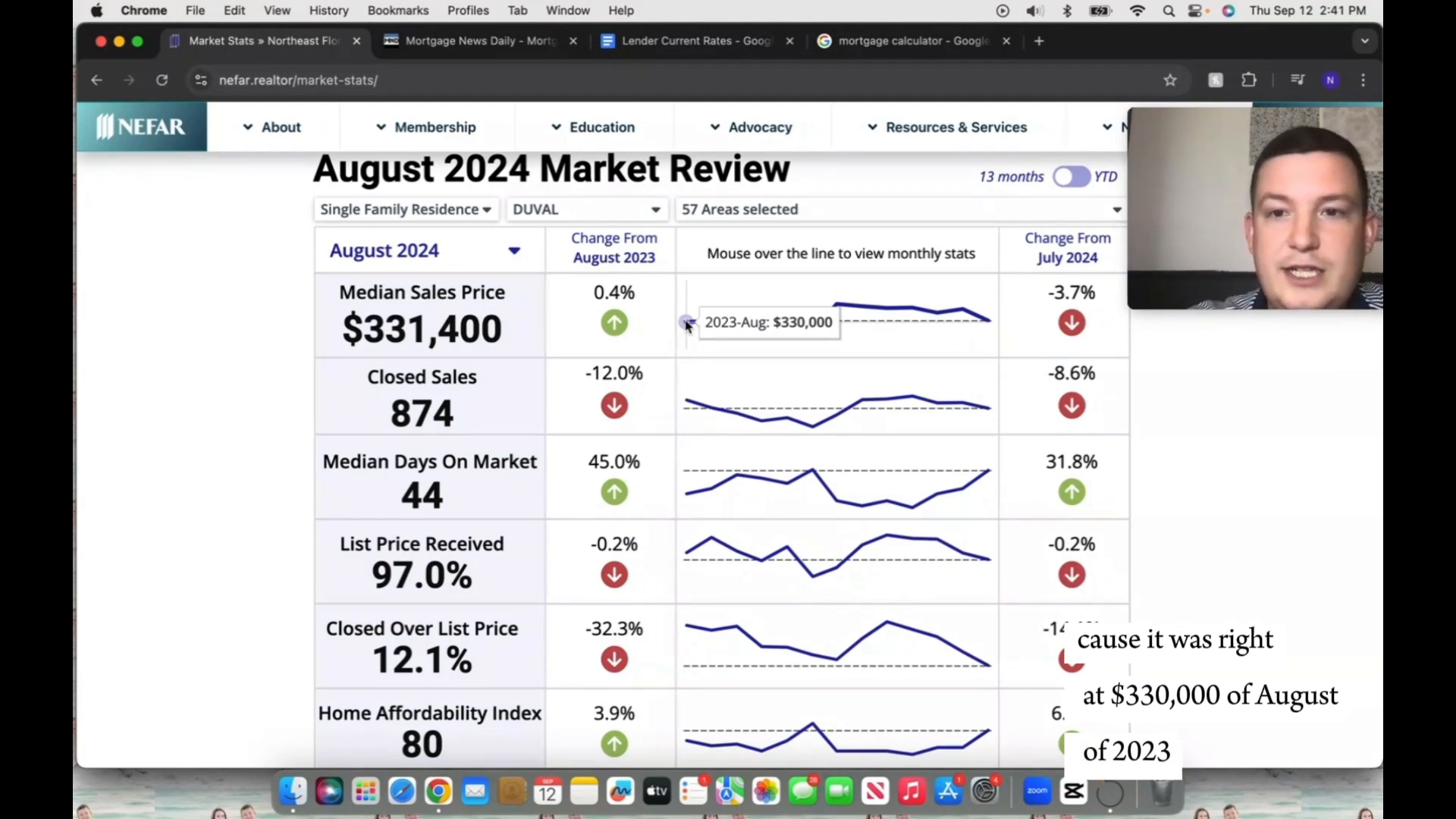

Median Sales Price

The median sales price has dropped nearly 4% to $331,400. This represents a stabilization in pricing, as it was approximately $330,000 in August of last year. The decrease indicates a more balanced market, moving away from the inflated prices seen in previous years.

Closed Sales and Days on Market

Closed sales have decreased by 8.6%, totaling 874 homes sold in August. This drop, combined with an increase in days on market, suggests that buyers are taking more time to make decisions. Homes are now sitting on the market longer, which is a critical factor for sellers to consider.

Inventory Levels

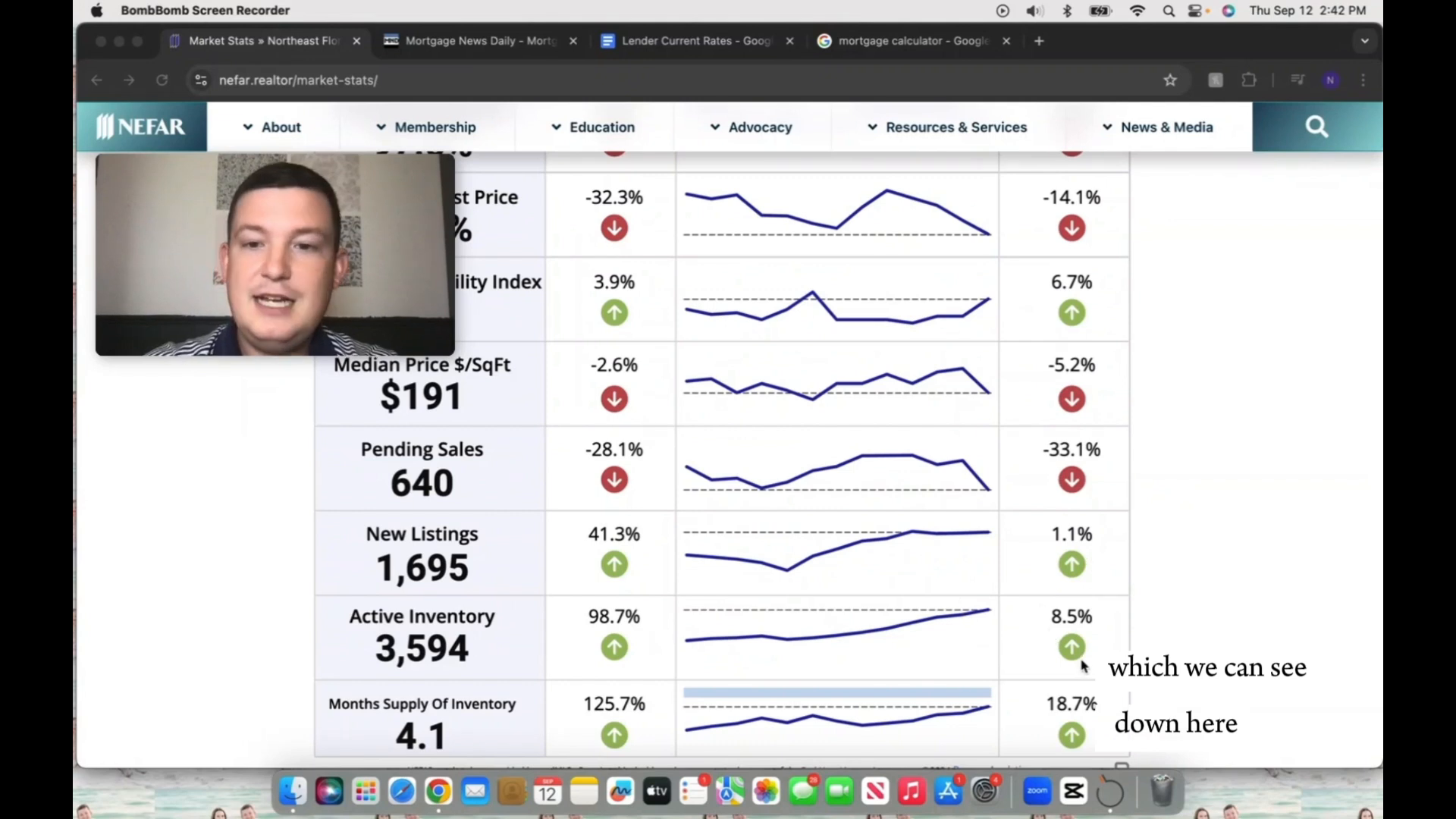

Active inventory levels have risen significantly, increasing by 8.5% from the previous month and nearly 98.7% from the same time last year. This surge in available homes gives buyers more options, which is crucial in a competitive market.

List Price Received

On average, homes are selling for about 97% of their asking price. For instance, if a home is listed at $100,000, it is likely to sell for around $97,000. This statistic indicates that while buyers have more options, they are still willing to pay close to the asking price for well-presented homes.

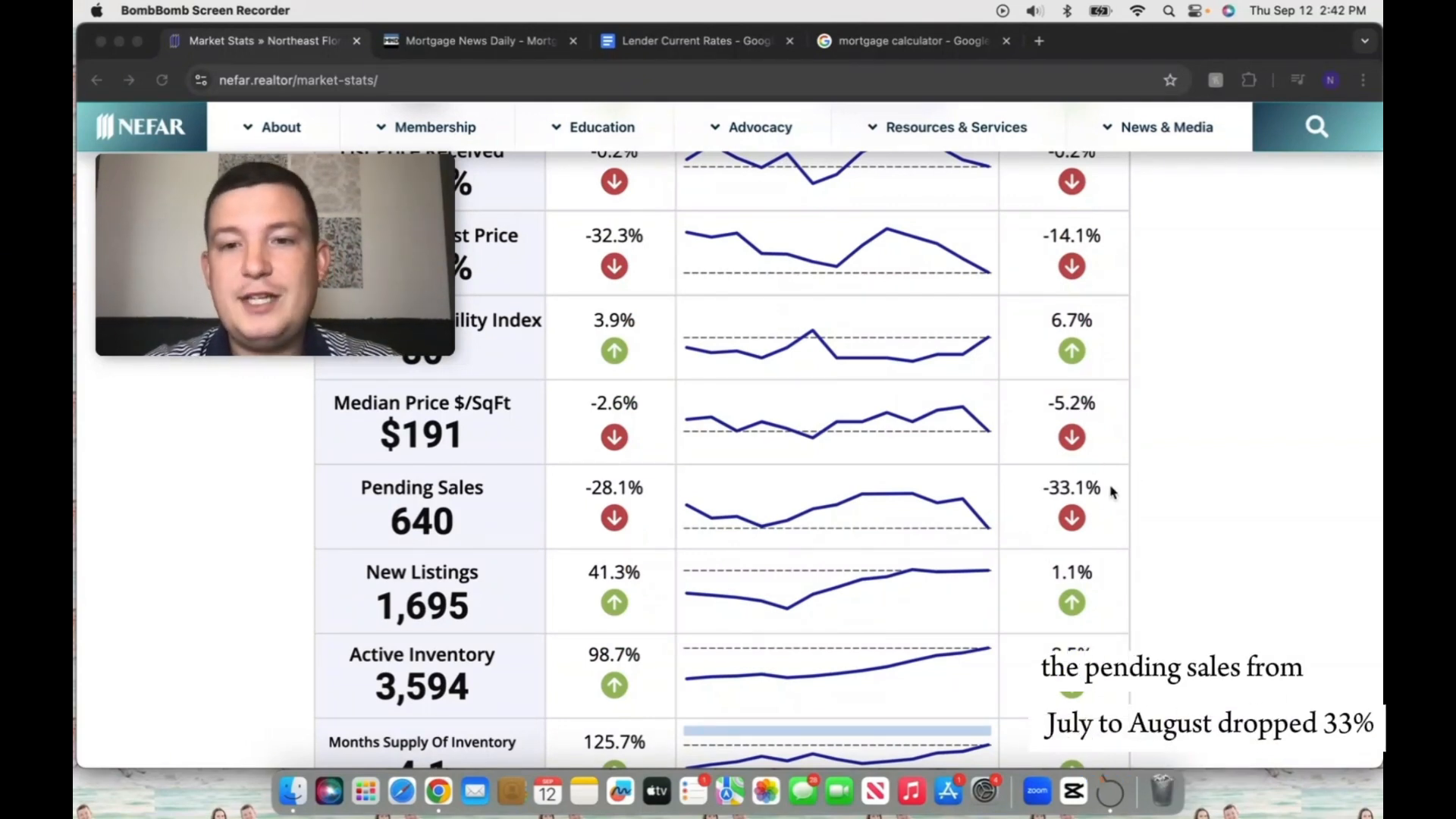

Pending Sales and Market Trends

One of the most striking statistics is the drop in pending sales, which fell by 33% from July to August. Last month, there were 957 single-family homes under contract, which decreased to 640 this month. This trend suggests a potential slowdown as we approach the holiday season.

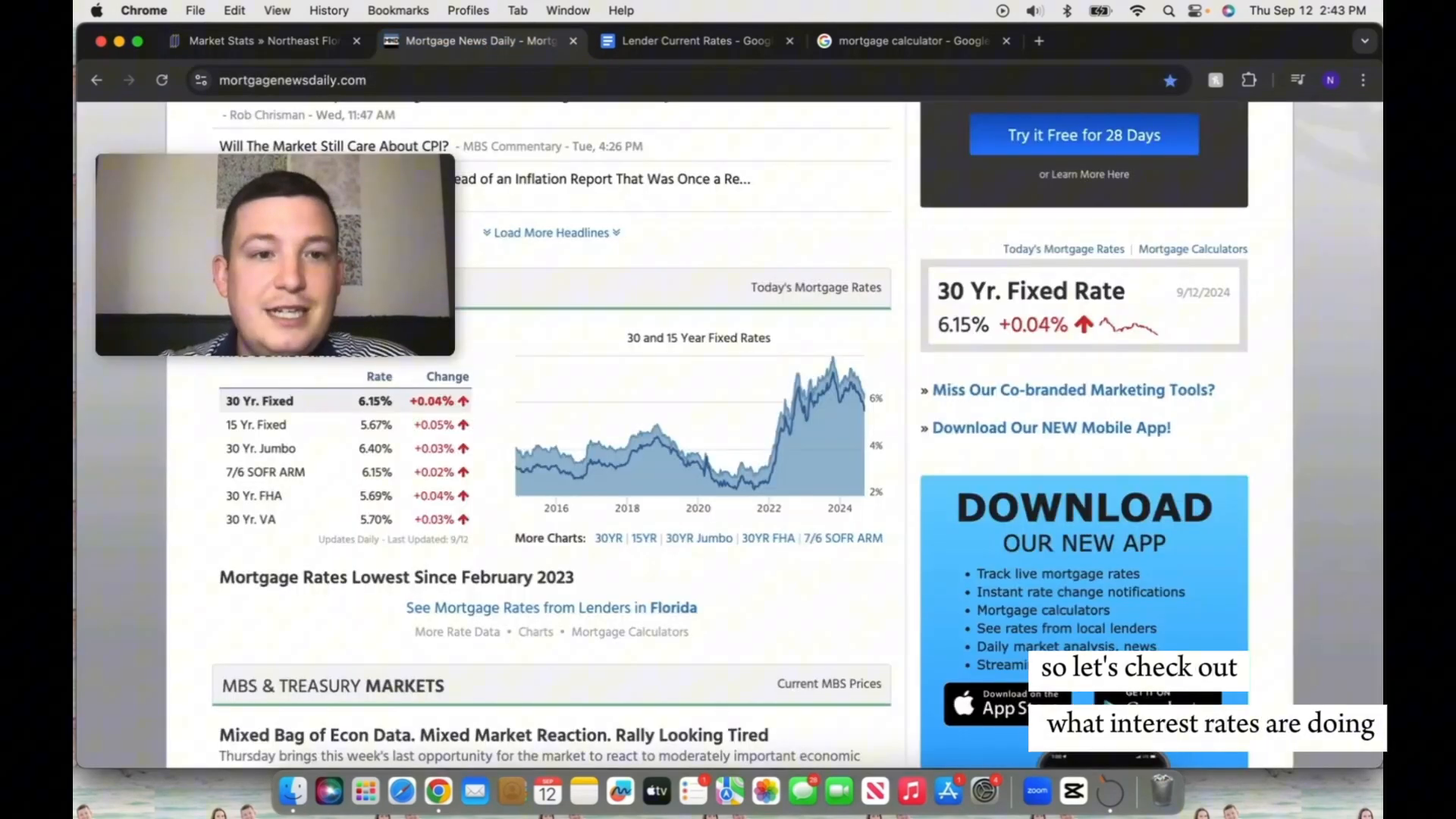

Interest Rates: A Positive Shift

Interest rates have recently seen a decline, which is good news for buyers. As of August 2024, the average rate for a conventional 30-year loan is 6.15%, the lowest it has been in 18 months. This decrease can significantly affect monthly payments and overall affordability for homebuyers.

Impact on Monthly Payments

To illustrate the impact of these rates, consider a buyer purchasing a home at the median sales price of $331,400 with a 10% down payment. At a 7% interest rate, the monthly payment would be approximately $2,563. However, with the current rate of 6.15%, this payment drops to about $2,396, saving the buyer nearly $150 to $190 per month. Over the life of the loan, this difference could amount to significant savings.

Purchasing Power and Market Dynamics

Interest rates greatly influence purchasing power. A 1% change in interest rates can lead to a 10% difference in what buyers can afford. For instance, if a buyer was considering a $500,000 home at a 6% interest rate, an increase to 7% would reduce their purchasing capacity to approximately $450,000.

Why Homes Are Selling More Slowly

With the increase in inventory and more favorable interest rates, homes are taking longer to sell. Buyers now have the luxury of choice, which means they are being more selective. Homes that are well-staged and priced competitively are more likely to attract serious buyers.

Conclusion

The Jacksonville real estate market in August 2024 presents a mix of challenges and opportunities. While prices have stabilized and inventory has increased, the decline in pending sales indicates a cautious approach from buyers. Nevertheless, the drop in interest rates provides a glimmer of hope for those looking to purchase a home.

For those interested in the latest trends and statistics in the Jacksonville real estate market, you can check out the Jacksonville August 2024 Real Estate Market Stats.

For personalized advice on buying or selling your home, feel free to book a 15-minute call with me.

Stay updated by following me on Instagram.

.jpg?alt=media&token=47c7857d-2e71-439f-a2d7-246977432edc/)

Schedule a Time To Discuss Next Steps

If you are looking to make a real estate move set up a time below for a quick phone call!

Lets Go!

Comments

Post a Comment